Dental TechScape

Thank you to my friend and mentor, Anna Khan, for inspiring and reviewing this piece.

"HealthTech is the new fintech". I've seen this statement being tossed around a lot recently, and for good reason.

The TLDR: Compliance has become relatively easier. With COVID, practices suffered, and ambitious builders see a massive greenfield to apply tech concepts to the $10bn outdated industry. There are more independent healthcare practices than there were 10 years ago.

Healthtech is a broad term, covering anything from data compliance to overpriced toothbrushes, drug discovery to being able to purchase prescription drugs in bulk.

Today, we'll be covering the 'Woolly Mammoth' of healthcare — dental software. Once an extinct behemoth, there are now some ambitious technologists looking to revive this beast (and make billions of dollars doing so).

Key Components

A dental clinic's operations can be grouped in two categories: front desk and back office.

The front-desk responsibilities are largely patient-centric, and can be best compared to the responsibilities of a sales & customer success team. Much like a sales rep would book demos and qualify the leads to pass over to an account executive, the front-desk team members own the schedule and ensure that all patients on that schedule have eligible insurance. After the appointment, they'll convey the payment information to the patient's insurance provider, and ensure the payment is collected.

The back-office is the product/service, and almost entirely clinical. The dentist, hygienist, and clinical assistant are responsible for performing the operation and ensuring high patient satisfaction. In tandem, there'll be the occasional supply purchases and external referrals (when the dentist is unable to perform a complex procedure and needs to recommend a specialist).

A quick summary: The front-desk handles the operations and everything that doesn't require a medical degree, while the back-office performs the procedure itself.

Software-wise, there's an underlying foundation that manages all patients' EHRs (electronic health records). This backbone is known as the Practice Management Software, and all other modules/components integrate into this PMS. Technically, these practice management softwares have all the features necessary to operate a dental clinic, though the outdated nature of these features led to net-new companies focusing on innovating and optimizing these modules.

From a GTM perspective, selling to the front-desk is nothing new. It's been done before, and will continue to be done, but the space is too saturated and the second and third movers simply don't have too much to show. Easy patient communication, online payments, automated reviews—it's all been done.

On the other side, selling to the back-office requires a product that changes the game (think: Dandy). Thus the reason there's simply not a lot of back-office software—the overlap between technologists and dental workflow SMEs (not just SMB-workflows), is tiny.

The Market Today

Some fast facts: The 2021 global market size for Dental Practice Management Software is reported at $1.37B and is projected to become a $4.7B market globally by 2030.

- 150,000+ dental practices across the nation

- Last 15 years, 12% drop in independently owned practices

- Over 10% are now a part of a larger organization

"Wait, what do you mean 'a larger organization?'"

Well, while most folks are used to going to a dentist that owns their own practice, remembers your birthday, and will ask you how your travels from ~2 years ago went, some dentists are strictly employees of the practice they work at. This is known as a 'Dental Service Organization' (DSO for short).

These DSO's are the 'business partners' in the practice. They'll take on the management, marketing, data, and financials to ensure the practice is growing as it should. In return, they take a majority of equity in the practice, and keep you, the dentist, employed.

"That sounds great, why wouldn't all the dentists just sell to a DSO?", you may ask.

Unfortunately, it's never as convenient as advertised.

What's pitched- Let dentists focus on clinical

- DDS not MBA. they care about doing good dentistry

- Efficiency and legal compliance

- Better work life balance for dentists

The reality

- Dentists do get to focus on patient care, but …

- DSOs over index on efficiency. Production trumps all other metrics, so customer satisfaction may drop.

- You are now an employee, not the employer. Any sense of flexibility is now gone, so even if you're given structured hours, these hours might not be comfortable for you.

Naturally, all the above is contentious. Some dentists will tell you that selling to a DSO was the best decision they made. Others will tell you their regrets, saying they would've much rather stuck it out, or brought on a consultant. Either way, it depends on the DSO. There're some bad apples, and good apples.

Your immediate reaction may be "okay, why wouldn't dentists just tough it out?". Most try to.

However, the operations of running a practice have gotten much, much harder.

- With more practices in the space, the more competition there is. There are always things to be doing to get net-new patients.

- With larger organizations cornering the market with better branding, cheaper pricing, simply being a good dentist isn't always enough.

Operational Difficulty

- Everything that a small business owner has to deal with, there's nothing new here.

- Regulatory, billing, labor shortage, supply chain issues, rising costs

- Being a dentist doesn't mean you're immediately qualified to own a dental practice.

Thus, the reason I bring up DSOs. While unfortunate that these aspiring business owners are being forced to give up how their practice is being run, there simply aren't that many options, primarily due to a lack of automation in the space. With no even playing field, those with more resources (read: DSOs) inherently succeed.

The TLDR of this: DSOs know how to buy software— they can cut costs, layer on basic organic marketing, clean up the tech stack, and start consolidating practices. This lowers the TAM though, and turns the entire industry into an amalgamation of PE rollups (not ideal).

Waves

Wave 1 - Information Management

The first push to technologize dentistry can be noted as Practice Management Software was introduced. Patient records were moved off of file cabinets and eventually migrated to a computer. EHRs were a massive jump in being able to share healthcare information with the patient and the patient's other providers, keeping information secure and accurate, as well as improve administrative efficiency. Initially, practice management softwares stayed local to a server, but in 2003, Denticon was released as the first cloud-based dental PMS.

Today, Dentrix (owned by Henry Schein, $HSIC) leads the pack with ~30% market share.

Wave 2 - Streamlined Communication

As practice management softwares became the status quo, so too did the simplification of external communications. On the practice<>insurance provider front, new web portals and streamlined processes made it easier for the practices' account coordinators to ensure each patient was eligible.

Communication between the practice and the patient saw similar innovation. Online forms simplified the pre-visit process. Email and text-based reminders made it easier for patients to confirm their appointment.

Wave 3 - HealthOps + Automation

I call this last wave 'HealthOps', inspired by my team at Ramp, and how we defined 'FinOps' as financial automation. Similarly, this next era of healthtech will consist of task automation, saving time and money at each corner.

What I envision coming next:

- Platforms that centralize all data will succeed, and many more will arise

- Recurring front-office tasks will become automated

- Onboarding of a patient will become 'self-service', with little-to-no human interaction

- Insurance and billing will become rapid fast

- Real estate is valuable, a dental office is even more valuable (given equipment). Services like https://www.pairdental.com/ will become more lucrative.

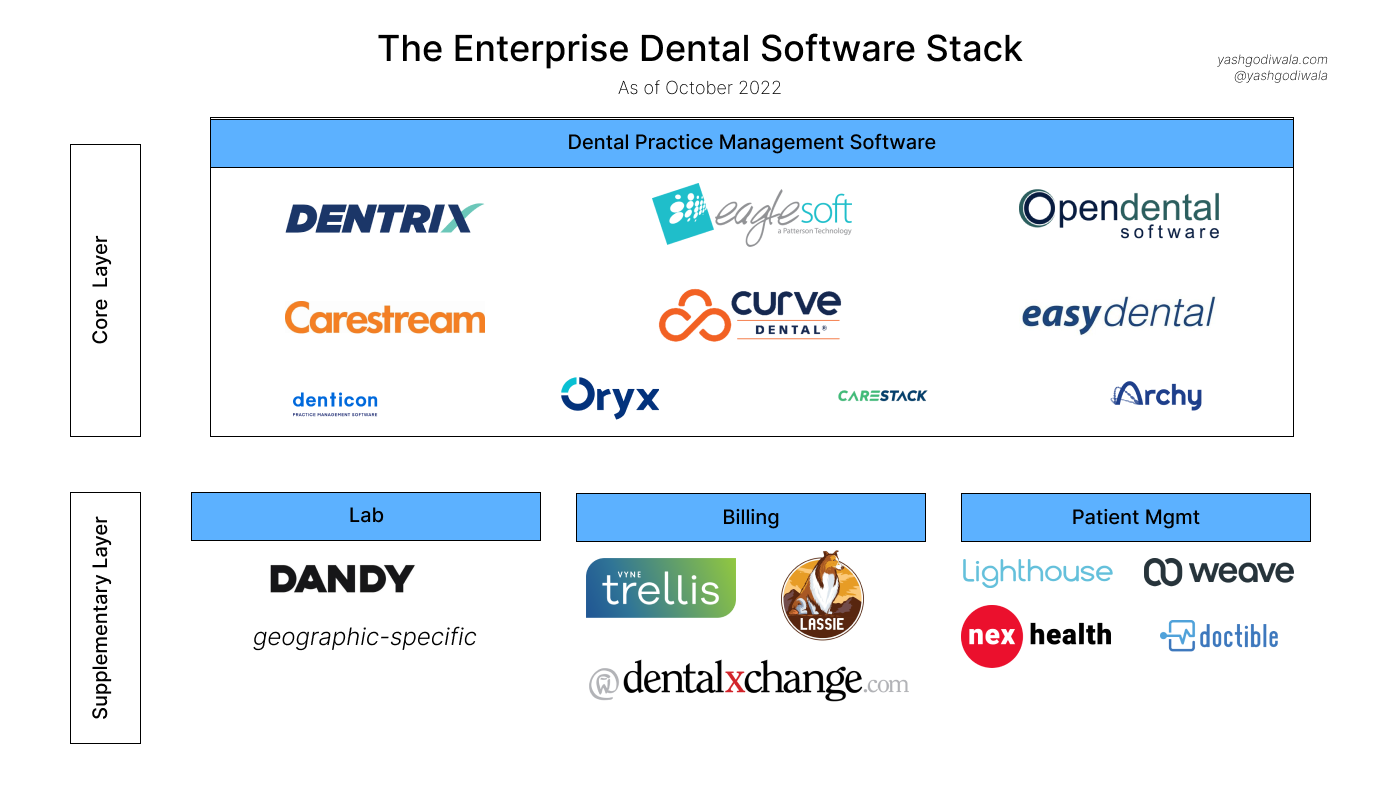

Landscape

This image displays how I see the dental-tech landscape today. If I missed a company you think deserves to be here, let me know. Intentionally left out in this graphic:

- Dental hardware (Henry Schein)

- Brick and Mortar Consumer Dental Practices (Tend, dntlbar)

- Microservices (Pearl, Pair Dental)

What's next?

I'm bullish on software that empowers the independent practice owner to focus on their patient, rather than mundane operations. This industry has historically depended on MBA-types to help them gain a competitive edge. The end goal is to provide the picks and shovels for them to do so themselves, in a lightweight manner.

The balance: the software needs to help the practice, but also the practice owner, with saving time and money. The best software here will play in the middle of the front-desk and back-office, serving as the foundation for the rest of the software to run.

Financial Automation / Reconciliation- The practice bills the insurance provider

- Insurance provider confirms this request, pays the practice, and provides receipt in a lump sum with several other patients in the same receipt.

- This can take 10+ hours each week and can result in thousands of dollars lost if not done properly.

Data

- Practice owners didn't go to business school, and often struggle with understanding how to boost net-profit.

- Creating dashboards and playbooks on how to improve practice growth would be helpful.

- Automating the creation of the bare minimum (lifecycle campaigns, ensuring that patient communication is done on time)

Consolidation

- Practice owners have more than 5 different tools they use to manage their practice, which becomes overwhelming.

- With the use of modern APIs, most operations can be consolidated into one platform for ease of use.

Patient-Centric

- The best companies are a win-win situation for all involved. Similarly, the next best enterprise dental software startup will transform the experience for the patient as well.

- Patients will have a portal to submit all necessary information for pre-visit

- All data, medical history, and billing will be available in-app to be self-service and boost revenue collection

Practice owners get burnt out because of the time they spend on business operations.

Providing the tools to simplify this will not only save time and money, but empower these small business owners to focus on what they do best.

- YG, October 2022